Payroll services in the cloud: Intuit’s QuickBooks

Nobody pays attention to your payroll system unless it's not working. When you're running a small business, it's no small task to please your staffers every payday and satisfy Uncle Sam at tax time. Larger companies employ payroll personnel to calculate taxes and withholdings, and to manage IRS forms correctly. But if you're responsible for cutting the checks at a smaller company, online services can automate most of the payroll chores.

Intuit Online Payroll can help you better understand and track the forms and filings required for your employees. Each service lets you access payroll information from a Web browser, smartphone, or tablet. These cloud-based tools also offer employees online access to paycheck details, W2 downloads, and even paid-time-off balances and 401(k) specifics. Which service is better for your business? We took a closer look to find out.

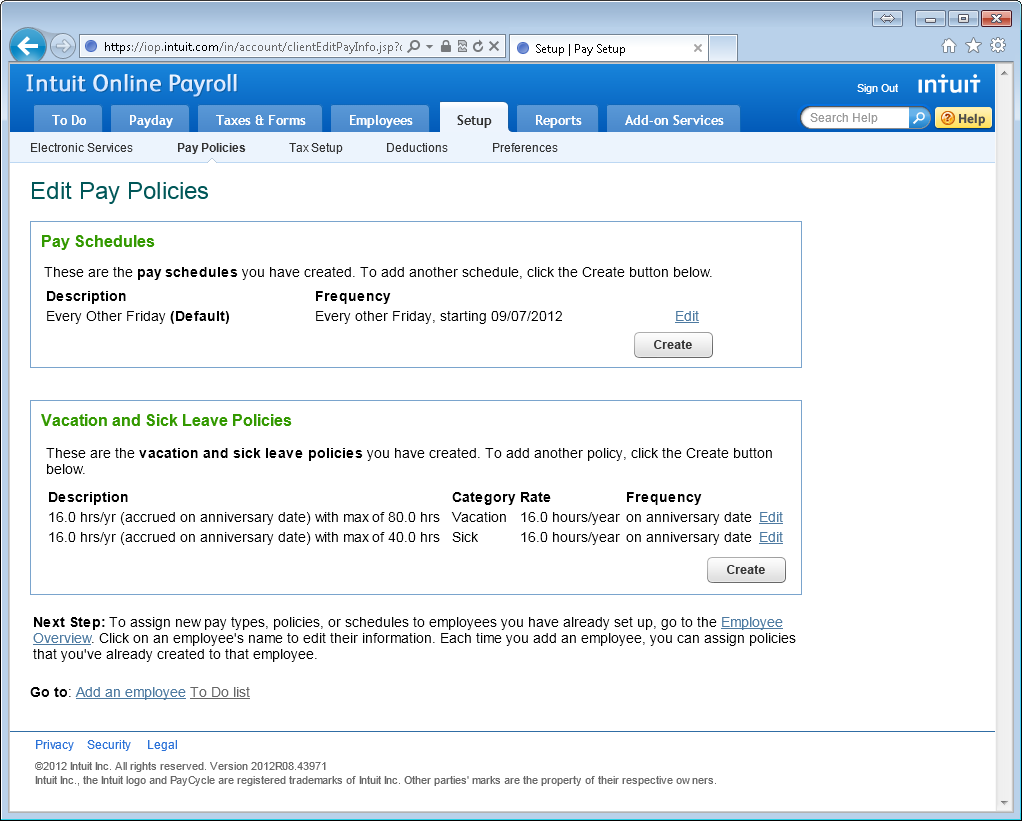

You get the usual payment schedule options with Intuit.

Intuit Online Payroll

Intuit Online Payroll is a great option for small businesses—especially those without prior payroll experience. It starts at $25 per month to manage paying employees and contractors, and rises to $39 per month to support federal and state tax forms. Under either subscription, Intuit charges an additional $1.50 monthly fee for each employee you pay. On top of that, Intuit Online Time Tracking, at a cost of $3 per month per employee, will track hours either via online timesheets that employees can edit, or through a multi user online time clock.

I calculated the estimated cost for Intuit Online Payroll for 15 employees. It added up to about $61 per month for the subscription that includes the tax forms, or about $106 per month with employee time-tracking. Intuit Online Payroll starts as a 30-day free trial period, which begins when you run the first pay period.

Intuit Online Payroll Plus ($39 a month) can also help you manage and track your federal, state, and local payroll taxes. It even supports electronic filings and a separate workers' compensation service.

Intuit's wizard-style setup interface asks about your pay schedule, direct deposit information, and vacation/sick-time policies. You can also input older payroll data if you’ve used another payroll system in the past.

When setting up individual employees, you can configure federal, state, and local tax withholding. Intuit provides the required tax forms, such as the W-4 (Employee Withholding Certificate), I-9 (Employment Eligibility Verification), and new-hire state forms. Supported deductions include insurance, retirement plans, flexible spending accounts, HSA plans, garnishments, and other items such as cash-advance and loan repayments. You can even add custom after-tax deductions. In addition to regular pay, it supports commissions, bonuses, holiday pay, overtime, reimbursements, allowances, tips, and other miscellaneous earnings and compensation.

For employee payments, Intuit supports free direct deposits, preprinted QuickBooks-compatible check stocks, blank check stocks, and plain paper stubs that can accompany handwritten checks.

Intuit Online Payroll offers employees online access to view their information, including paycheck details, as well as to download W2s. Intuit also supplies free apps for iPhone and Android that let you perform most payroll-management tasks, but it doesn't provide mobile access for employees.

Hope this article will be beneficial for you. To get more information and best support, dial QuickBooks Online Support Phone number 1-855-441-4417.

Information Source: http://www.pcworld.com/article/2010572/payroll-services-in-the-cloud-intuit-vs-adp.html

Comments

Post a Comment